Learning Concerning the www.online-pay-stub.com and the Perfect Sort of Template

Most new business owners have likely never filled out a payroll stub and consequently, have only a limited idea about what information has to be included. The very best approach to make certain that the stub you devote to your employees is correct your very best choice is to use a template to make a www.online-pay-stub.com which will utilize your personal computer accounting program.

A template is a guide which may be used to supply you with the fundamental theories of how to make www.online-pay-stub.com. With the majority of templates, you'll realize that you could customize them to suit your business's specific needs. Often times you'll discover that there's specific information your employees will request that you include in their www.online-pay-stub.com, by deciding on the best template you'll have the ability to bring this information to their own payroll stubs rather readily.

What a Template Used to Produce www.online-pay-stub.com Should Consist of

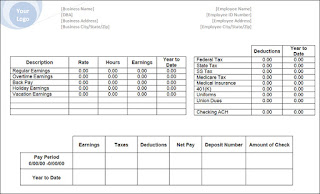

Your workers and national laws are going to need that you include specific details on every www.online-pay-stub.com. This information will be contained in the ordinary template used to make www.online-pay-stub.com and often times could be filled in automatically from the database. Each stub needs to have a room for the worker's name and address. There should be lines due to his or her social security number, the hours he's worked broken down to regular hours and overtime hours.

After this, his hourly charges must be recorded to avoid any question of exactly what he's getting paid. The total of hours worked should be revealed in addition to the gross pay. This should be outlined for several taxes, social security and Medicare deductions in addition to any others like insurance premiums. This way your workers are able to understand where each dollar they've earned goes until they get the lowest figure or web pay.

If you would like to keep your workers happy then you need to look on the internet for a template which will produce www.online-pay-stub.com which you may use in combination with your accounting software to create their cover slips easily each pay period. Using a template can save you both time and annoyance each time payday comes about.